PERSONAL LOANS REIMAGINED

Find out morePERSONAL LOANS REIMAGINED

Find out moreBETTER PRICED

Assessing your future and past to offer you better and fairer rates

SIMPLE AND FAST

Application process only takes a few minutes; no lengthy forms

LOWER RISK

Payments adjust to salary, making repayments easier to pay

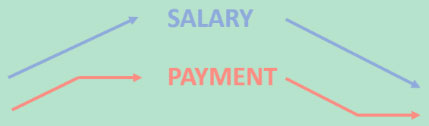

Your payments are based on a

PERCENTAGE OF YOUR SALARY to IMPROVE AFFORDABILITY

That means, as you EARN MORE, your PAYMENTS

INCREASE and your TERM DECREASES

and if you have a period where you EARN LESS, your

PAYMENTS DECREASE and your TERM INCREASES

GOCAP has built in a MAXIMUM AND A MINIMUM

MONTHLY PAYMENT, so it’s not open-ended

The TOTAL REPAYABLE ALWAYS REMAINS FIXED, which means that the TERM OF THE LOAN IS VARIABLE